According to Congressional testimony by Treasury Secretary Timothy Geithner,

While many believe that all 19 banks will "pass" the tests, there is still likely to be some adversity and the government will, regardless of the outcome, likely ask some or all of the 19 banks to beef up their capital levels.""one of the major components of the Administration's Financial Stability Plan (FSP) is the Capital Assistance Program (CAP). The CAP is designed to ensure that individual banks have sufficient capital even in adverse circumstances. This strategy begins with the idea that in order to ensure our largest banks have adequate capital to weather a more severe economic scenario and continue to lend, we must first accurately diagnose their problems. Federal banking agencies will soon complete a forward looking assessment or "stress test" for the 19 largest banks. The stress tests will determine the capital needs of these banks by estimating losses that they might face if economic conditions were to deteriorate more than expected over the next two years, as well as the appropriate level for loss loan reserves at the end of the period. The analysis will take into account the likely path of earnings for individual banks over the same period. By focusing on individual banks, this approach allows the analysis to take into account the unique exposures that individual banks face as well their individual prospects for generating earnings.

The release of information will prompt the media and consumers to elevate discussion of the capital adequacy of ALL banks. As this occurs, more and more chat will take place relative to non-stress test banks and their capital adequacy. As such, it will be critical and a perfect opportunity for all banks to monitor conversations occurring on the Internet that specifically involve them as well as general consumer concerns regarding banks. We saw this happen in mid-2008, after the crash of IndyMac Bank. This is likely to spark a second round.

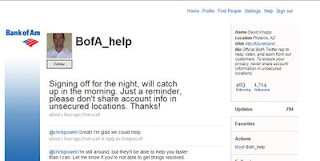

On April 10th I posted Banking Regulators Should Make Use of Social Media Mandatory. In this post I focused on the importance of utilizing social media for risk management purposes - particularly reputation risk. Now is the time for bankers to create a plan that listens in on conversations specific to their bank as well as concerns overall. Bankers should assign a "community manager" to track activity. Additionally, this person should either act as the mouthpiece for the organization or run "traffic" by making sure that the right people respond to the issues in a prompt and honest manner.

In 2008, federal regulators and banking associations encouraged banks to create a crisis response program. This was part of the industry's effort to calm consumer fears regarding bank failures. While the requirements did not specify the use of social media, the use of social media as part of a crisis management/risk management program can assist in keeping adverse effects to a minimum and will allow banks to turn around a generally negative environment by being received as informed, honest and transparent. When using social media as a corporate communication channel banks must be aware of the nuances and expectations of consumers. This information can be obtained from my Community Banker's Guide to Social Network Marketing,which is a free download at http://www.tinyurl.com/cbgsnm. In addition, bankers should be aware of any other regulatory disclosure requirements to the extent that those are applicable (e.g., SEC rules, consumer disclosure rules, etc.).

Forewarned is forearmed.