According to the Twitter Web site, Twitter is a privately funded startup with offices in San Francisco, CA. Twitter started as a side project in March of 2006 and has grown into a real-time short messaging service that works over multiple networks and devices.

What Good Are 140 Character-Long Messages

Most bankers' first response to Twitter is "so what!" Why should I, as a banker, care about Twitter? What is all the fuss about?

According to Matt Dickman, VP of Digital Marketing at Fleishman-Hillard, “Twitter is the ultimate customer service tool. It’s live, instantaneous, community driven, open, two-way and multi-way, unfiltered and predictive.“

Imagine this scenario...a bank customer is traveling in a foreign country and attempts to withdraw funds from an ATM. The time back home is the middle of the night and the ATM system is down for maintenance. The ATM message states that the transaction was denied - nothing else.

Scenario 1): The bank customer becomes infuriated that he could not withdraw funds. He eventually gets money out at a later time but is steamed his entire trip. Because this customer is of the Generation Y, the first thing he does, if he hasn't already done so, is let all of his acquantances know of the horrible service. The customer reaches out to his friends on Twitter, Facebook, MySpace and blogs. The result is a permanent record of his experience on the Internet for others to see. A digital black eye on the face of the bank. Once he finishes venting, he goes online, transfers all his money to another bank (which he opened online) and sends a message to close his account.

Scenario 2): The bank customer realizes that something is wrong since he has plenty of funds in his account. He gets on his iPod and sends a Twitter message (known as a "tweet") to the bank's call center. The assigned call center operator sees the message and sends back a quick message indicating that the ATM network is down for the next 20 minutes (you may have offline limits in place but probably don't want to broadcast these). The customer walks around the corner for a cup of coffee and returns 20 minutes later. Tada! Money. The customer enjoys the rest of his vacation and returns home. When asked about his trip he states that it was great. He mentions that along the way he had an ATM problem but that the bank's customer service department told him exactly what he needed to know when he sent a tweet. His friends are shocked that banks can actually be so responsive and customer focused. The Twitter tale gets passed on from one friend to another. Eventually, when it is time to open an account, some of the customer's friends decide to open an account at the bank because of the Twitter tale.

So who would go to all the trouble? Well, banks that "get it." That's who.

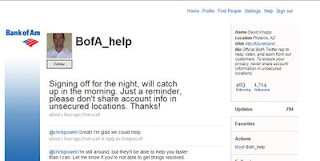

A good example of a bank that gets it is Bank of America. In January 2009, BofA launched its Twitter presence using the user ID BofA_help.

According to Holly Hastings on BofA's Future Banking Blog, "with the advent of social networking sites and blogs, companies have the opportunity to listen and learn from their consumers in ways that were not possible before. Companies can gain powerful knowledge on everything from product enhancements, customer service interactions and unresolved problems–but only if they listen. Social networking sites like Twitter enable that listening in real time." Other tweeters include UMB and Wachovia.

In a Februay 2009 ABA Banking Journal article, Pete Fields, Wachovia's senior vice-president and e-business director for corporate services and Web 2.0 said, “in August we started with Twitter because we wanted to develop a corporate competency in this type of social media. Our ‘followers’ have been very supportive about our presence on the platform. I believe they see it as a validation.” In the same article, Pamela K. Blase, senior vice-president and director of corporate communications, UMB Financial Corp., Kansas City, said that her bank started using Twitter to share information about the unfolding financial crisis.

According to the ABA Banking Journal, "the broader world of corporate Twitter users has also adopted the tool to stay in sync with their customers—and ease any daily tensions that are bound to erupt." As illustrated in the example above, a customer service strategy that utilizes Twitter (or a similar technology) can prevent every day issues from escalating into reputation damaging episodes. And the beauty of it is that Twitter communications are efficient at a maximum of 140 characters per tweet.

According to Carol Forsloff, despite the benefits of social media and Twitter, in particular, some businesses are afraid of having negative information posted - even if it is just 140 characters worth of griping. Ms. Forsloff, reminds businesses that criticism provides an opportunity to defend their business and explain their position. In the example above, the tweet allowed the bank to describe the issue not as a breakdown in the system but a scheduled outage for the purpose of maintaining the network.

So who should care about Twitter? Any bank that truly is interested in improving the customer experience. By leveraging this technology and incorporating it into an existing customer service infrastructure, banks can create considerable goodwill by demonstrating that they "get it" and are committed to dealing with customers on their terms.

No comments:

Post a Comment